Accounts Payable Outsourcing

Accounts Payable by First Credit Services

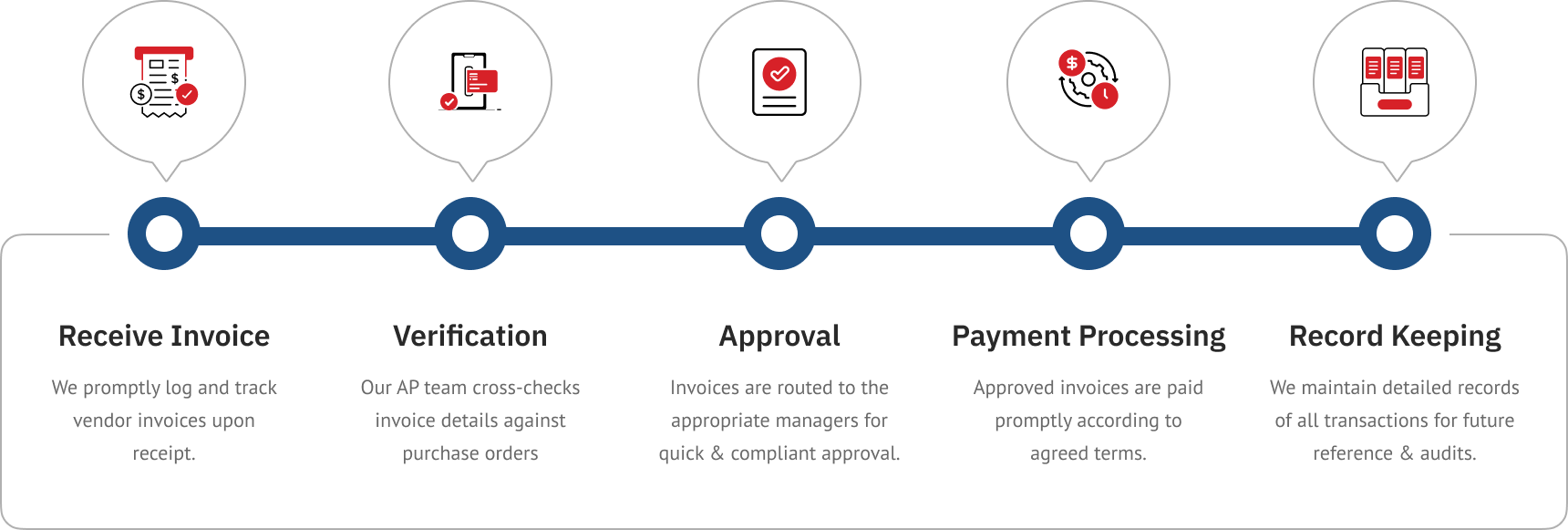

Accounts Payable Workflow at First Credit Services

Why Outsource Your Accounts Payable?

Cost Savings

Outsourcing eliminates the need for in-house AP staff, reducing salaries, benefits, and office space costs. It also provides access to advanced AP automation software, which can be expensive to implement internally.

Efficiency and Accuracy

Outsourcing providers have robust procedures and security measures in place to safeguard sensitive financial data. Streamlined processes and automation reduce the risk of human error.

Security and Control

Outsourcing providers have robust procedures and security measures in place to safeguard sensitive financial data. Streamlined processes and automation reduce the risk of human error.

Focus on Core Business

By outsourcing AP, internal resources are freed up to concentrate on core business activities. Providers also offer expertise in optimizing payment schedules & managing cash flow effectively.

Vendor Relations

Having an efficient AP process promotes positive vendor relations and eliminates supply chain disruption due to delayed/missed payments.

OUR INSIGHTS

The Latest From First Credit Services

Customer Service Outsourcing

21 June 2023Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Failed Payment Management

21 June 2023Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Cancellation Management- Save More Members and Improve the Environment of Your Club

23 June 2022Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Get in touch

Interested to know more? We can help.

Frequently Asked Questions

What tasks are typically included in accounts payable outsourcing?

Accounts payable outsourcing covers invoice receipt, data entry, three-way matching, vendor communication, payment scheduling, and account reconciliation. Many providers also handle compliance checks, reporting, and dispute resolution, helping businesses improve efficiency while reducing manual errors in financial operations.

How does outsourcing accounts payable affect cash flow management?

Accounts payable outsourcing improves cash flow by ensuring invoices are processed quickly and paid on time. This reduces late fees, strengthens vendor trust, and provides real-time visibility into outstanding liabilities. With better insights into payables, businesses can forecast expenses more accurately and manage working capital more effectively.

Can outsourcing accounts payable help manage seasonal or sudden workload spikes?

Yes, outsourcing accounts payable gives businesses the flexibility to scale resources during seasonal peaks or sudden growth. Providers can quickly add staff and technology to process higher volumes of invoices, ensuring accuracy and timeliness. This prevents backlogs, reduces strain on internal teams, and maintains consistent payment cycles year-round.

What industries benefit the most from accounts payable outsourcing?

Industries with heavy invoice volumes such as retail, manufacturing, healthcare, logistics, and construction benefit most from accounts payable outsourcing. These sectors face challenges like manual errors, compliance requirements, and complex vendor networks. Outsourcing ensures faster processing, improved accuracy, and stronger vendor relationships while keeping costs under control.Many businesses also save time by getting work done faster and more accurately. Over time, this leads to better cost control without lowering service quality.