Maximize Your Revenue with Accounts Receivable Outsourcing

Enhance your collection rates and accelerate your payment processing with expert

Accounts Receivable services from First Credit Services.

Accounts Receivable services from First Credit Services.

Accounts Receivable by First Credit Services

The Accounts Receivable process plays a crucial role in ensuring that organizations receive their payments within a specified timeframe. By implementing effective strategies and utilizing streamlined procedures, this process not only enhances collection rates but also accelerates payment processing. One of the key advantages of outsourcing accounts receivable management services to FCS is a well-executed process with the assurance of timely payment receipt. By establishing clear payment terms and actively following up on outstanding invoices, organizations can minimize delays and uncertainties associated with payment collection. This predictability fosters financial stability, allowing businesses to plan and allocate resources more effectively.

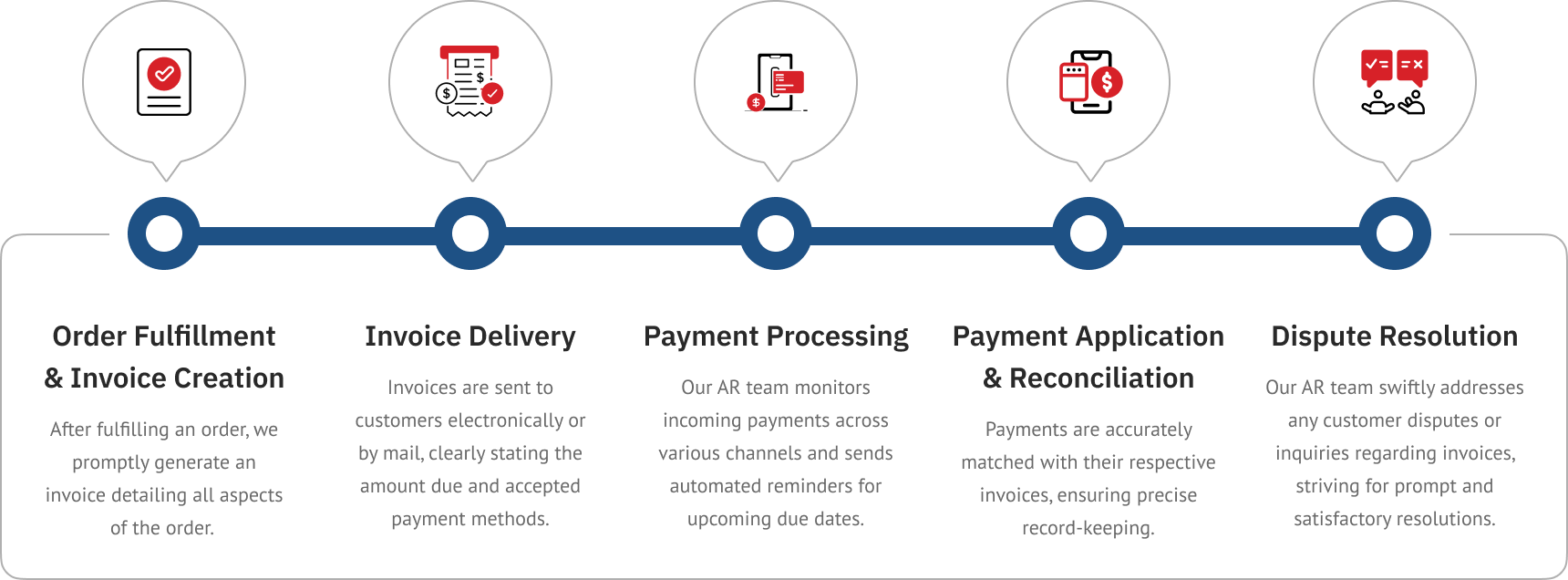

Accounts Receivable Workflow at First Credit Services

Why Outsource Your Accounts Payable?

Cost Savings

By leveraging the expertise and infrastructure of a specialized third-party service provider, organizations can avoid the costs associated with hiring and training in-house staff, purchasing software and technology, and maintaining an Accounts Receivable department

Efficiency and Productivity

By delegating time-consuming activities such as invoice generation, payment processing, and collections to experts, internal staff can allocate their time and energy to more strategic and revenue-generating activities

Industry Expertise

Service providers often have dedicated teams with expertise in credit management, collections, and debtor communications. They stay updated with industry best practices and regulatory requirements, ensuring compliance and maximizing recovery rates

Scalability and Flexibility

During periods of high transaction volumes or business growth, service providers can quickly ramp up their resources and adjust staffing levels to meet demand. Conversely, during slower periods, businesses can scale back without the need for layoffs or idle resources.

Risk Mitigation

Service providers employ established processes and tools for credit checks, monitoring customer payment behavior, and managing delinquent accounts. Their expertise in dealing with debtors, including negotiation and dispute resolution, can help minimize bad debts and improve cash flow.

OUR INSIGHTS

The Latest From First Credit Services

Customer Service Outsourcing

21 June 2023Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Failed Payment Management

21 June 2023Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Cancellation Management- Save More Members and Improve the Environment of Your Club

23 June 2022Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Get in touch

Interested to know more? We can help.